knoxville tn state sales tax rate

Local Sales Tax is 225 of the first 1600. Knox County Tennessee has a maximum sales tax rate of 975 and an approximate population of.

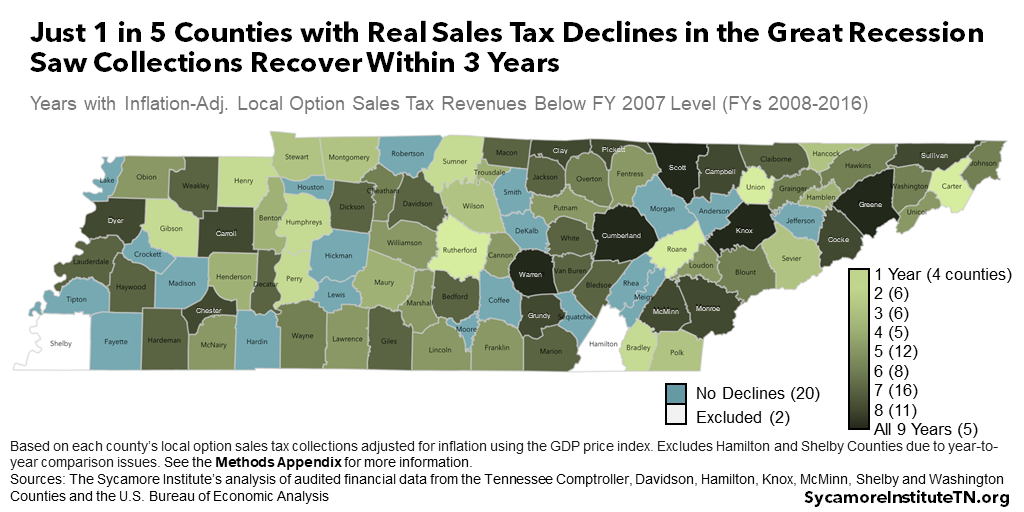

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Groceries are taxed at 5 some locations charge more and some services have a different tax rate.

. 31 rows Kingsport TN Sales Tax Rate. The 2018 United States Supreme Court decision in South Dakota v. Sales is under Consumption taxes.

The general state tax rate is 7. This amount is never to exceed 3600. Knoxville Tax jurisdiction breakdown for 2022.

The base state sales tax rate in Tennessee is 7. 925 7 state 225 local City Property Tax Rate. You can either collect the sales tax rate at the buyers ship-to address for all orders shipped to Tennessee ie.

Sales Tax Knoxville 225. There is a maximum tax charge of 36 dollars for county taxes and 44 dollars for state taxes. The average sales tax rate across all counties and municipalities is 9614.

2022 Cost of Living Calculator for Taxes. Knoxville Tennessee and Clarksville Tennessee. 1 State Sales tax is 700.

Counties and cities can charge an additional local sales tax of up to 275 for a maximum possible combined sales tax of 975. 4 rows The latest sales tax rate for Knoxville TN. This rate includes any state county city.

24638 per 100 assessed value. City of Knoxville Revenue Office. Our Premium Cost of Living Calculator includes State and Local Income Taxes State and Local Sales Taxes Real Estate Transfer Fees Federal State and Local Consumer Taxes Gasoline Liquor Beer Cigarettes Corporate Taxes plus Auto Sales Property.

Minimum combined sales tax rate value. 24638 per 100 assessed value county property tax rate. 3 rows The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and.

1 State Sales tax is 700. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None.

The Tennessee state sales tax rate is currently. 67-6-102 67-6-202 Sales or Use Tax The sales or use tax is a combination of a state tax 7 and a local option tax which varies from 150. Sales is under Consumption taxes.

Tennessee allows sellers to do one of two things. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275. With local taxes the total sales tax rate is between 8500 and 9750.

The knoxville tennessee sales tax rate of 925 applies to the following 22 zip codes. County Property Tax Rate. The 925 sales tax rate in knoxville consists of 7 tennessee state sales tax and 225 knox county sales tax.

Current Sales Tax Rate. State Sales Tax is 7 of purchase price less total value of trade in. Tennessee has 779 special sales tax jurisdictions with local sales taxes in addition to the state sales tax.

3750 with affidavit of counseling. This is the total of state and county sales tax rates. The Knox County sales tax rate is.

To review the rules in Tennessee visit our state-by-state guide. Purchases in excess of 1600 an additional state tax of 275 is added up to a. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales.

Destination-based sourcing or you can collect the state sales tax rate of 7 and just add 225 to all purchases meaning you would charge a flat 925 rate to all Tennessee buyers. Find your Tennessee combined state and local tax rate. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Sales Tax and Use Tax Rate of Zip Code 37995 is located in Knoxville City Knox County Tennessee State. 9750 without affidavit of counseling. Has impacted many state nexus laws and sales tax collection requirements.

Sales Tax and Use Tax Rate of Zip Code 37932 is located in Knoxville City Knox County Tennessee State. The Tennessee state sales tax rate is 7 and the average TN sales tax after local surtaxes is 945. 212 per 100 assessed value.

The lowest total tax rate in Tennessee is 85. Knoxville TN Sales Tax Rate. Sales Tax State 700.

Local collection fee is 1. This tax does not apply to. The sales tax is comprised of two parts a state portion and a local portion.

The local tax rate varies by county andor city. There is a state sales tax of 7 and local tax imposed by city county or school districts no higher than 275. Tennessee sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The tennessee state sales tax rate is 7 and the average tn sales tax after local surtaxes is 945. Estimated Combined Tax Rate 925 Estimated County Tax Rate 225 Estimated City Tax Rate 000 Estimated Special Tax Rate 000 and Vendor Discount None. Local tax rates in Tennessee range from 0 to 3 making the sales tax range in Tennessee 7 to 10.

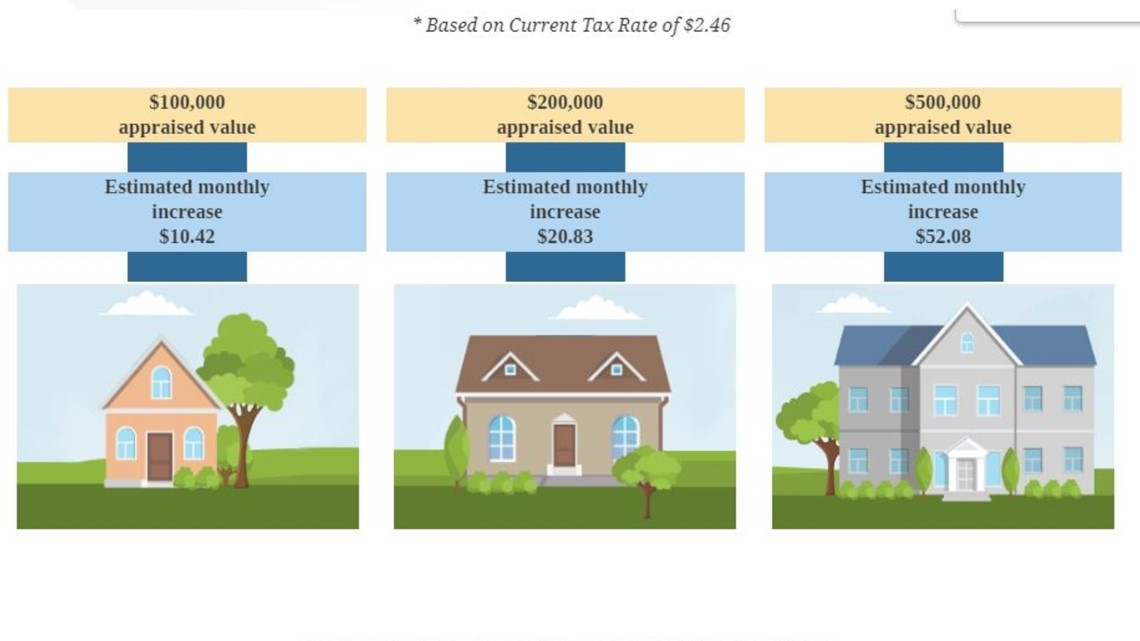

Knoxville Tennessee May Implement Property Tax Increases

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tennessee Income Tax Calculator Smartasset

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

The Ultimate Guide To Tennessee Real Estate Taxes

Tennessee Sales Tax Rates By City County 2022

Knoxville Property Tax How Does It Compare To Other Major Cities

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Tn 6th Most Regressive Tax System In Us R Nashville

Historical Tennessee Tax Policy Information Ballotpedia

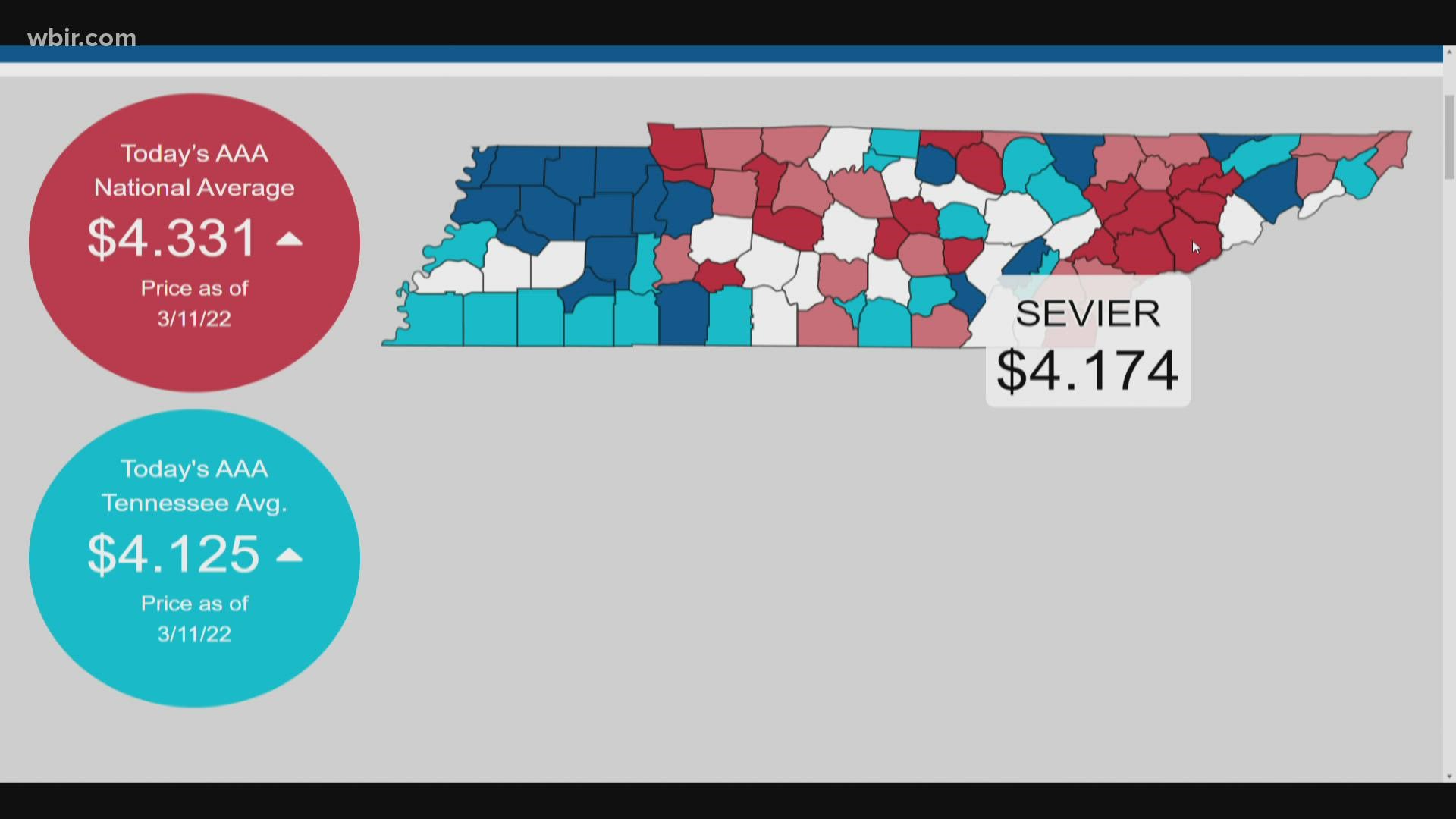

Gov Lee Has No Plans To Halt Tn S Gas Tax Amid Price Surge Wbir Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Knoxville Mayor Proposes Property Tax Increase In New Budget Wbir Com

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

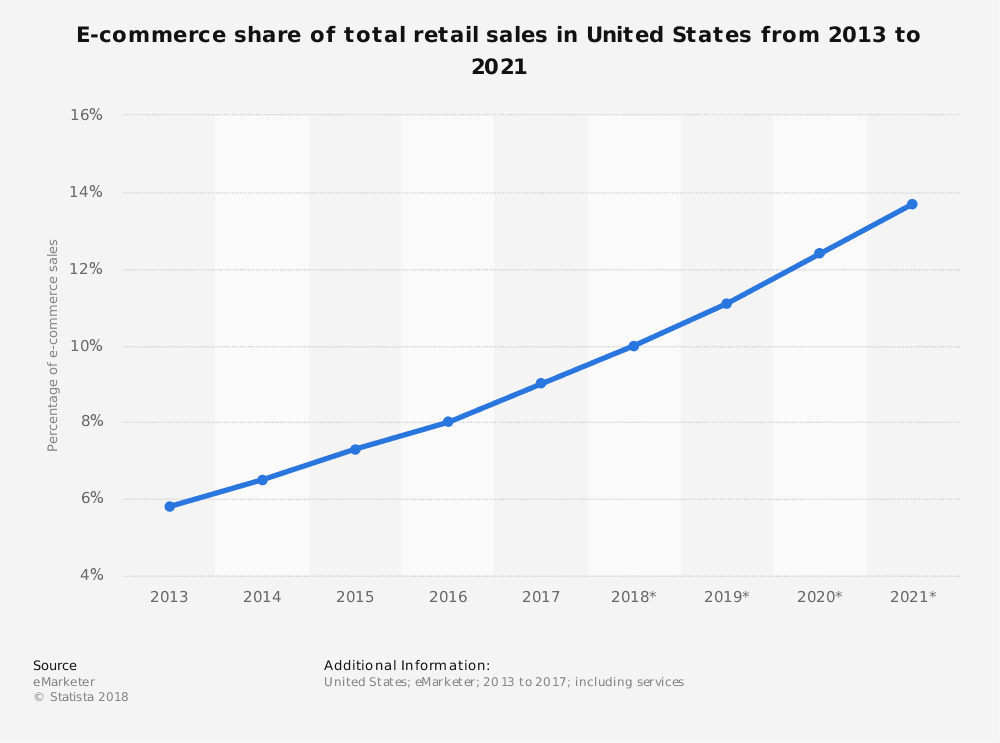

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Taxes Powerpoint Notes Part 3 Sales Tax This Is The Tax Added Onto The Price Of Goods And Services Tennessee Has A State Sales Tax The State Ppt Download